Overview:

Payroll departments receive and submit hundreds of thousands of bits of data each and every year. Employee master file data such as name and social security number, employee forms such the Form W-4, reports to the IRS such as Form 941, state unemployment insurance quarterly returns, termination dates for employees, and even child support withholding orders.

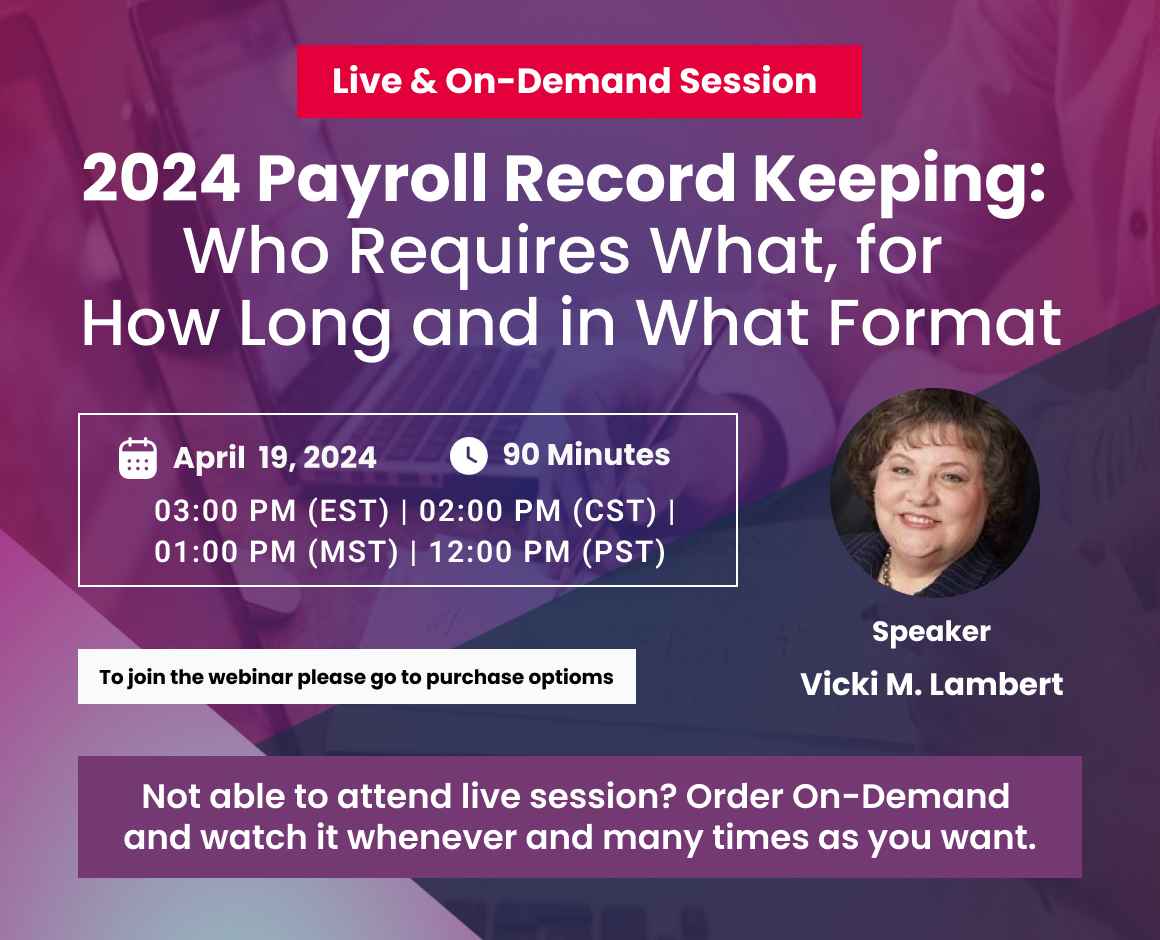

A critical question that every payroll professional must ask and more importantly answer is “What am I required to keep, in what format, and for how long”? That is what this webinar will discuss. We will focus on the details at the federal level for the major laws including the Fair Labor Standards Act, the Internal Revenue Code, and Child Support Enforcement. We will discuss how long records must be kept and in what format. We will review the records needed when a merger or acquisition has taken place and whether or Sarbanes-Oxley is still relevant when it comes to record keeping. We will also review how to keep the data secure to ensure that what is retained is safe and intact when and if it is ever requested.

Areas Covered in the Session:

- The importance of record keeping in a payroll department

- Regulatory agencies with payroll record-keeping requirements including:

- Department of Labor

- IRS

- Child Support

- Others

- Details of exactly what data needs to be saved and in what format can it be kept

- Does Sarbanes-Oxley still matter for record-keeping?

- Mergers, acquisitions and how it affects payroll record keeping

- Keeping the data secure to remain in compliance

Who Can Benefit:

- Payroll Executives/Managers/Administrators/Professionals/Practitioners/Entry Level Personnel

- Human Resources Executives/Managers/Administrators

- Accounting Personnel

- Business Owners/Executive Officers/Operations and Departmental Managers

- Lawmakers

- Attorneys/Legal Professionals

- Any individual or entity that must deal with the complexities and requirements of Payroll compliance issues

Reviews

There are no reviews yet.